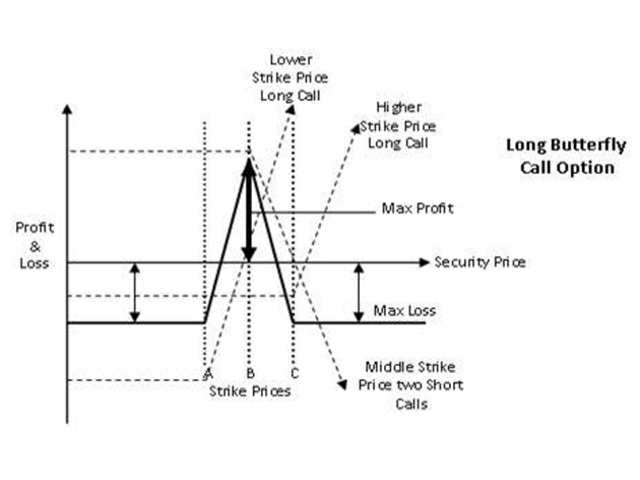

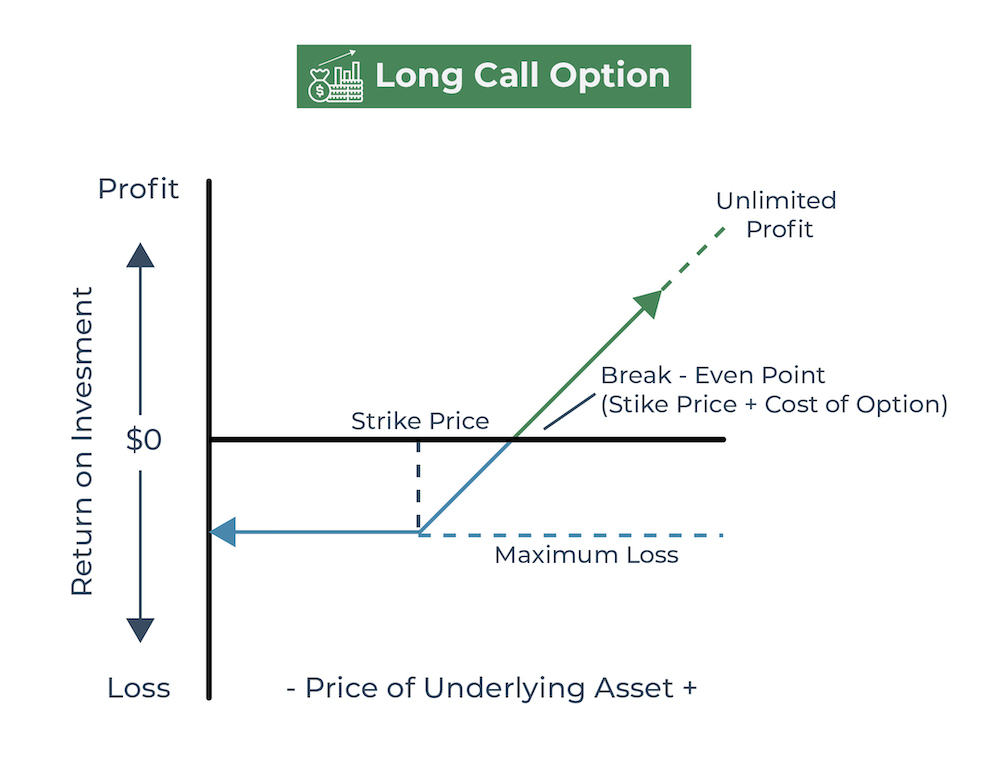

What is Butterfly Spread Option? Definition of Butterfly Spread Option, Butterfly Spread Option Meaning - The Economic Times

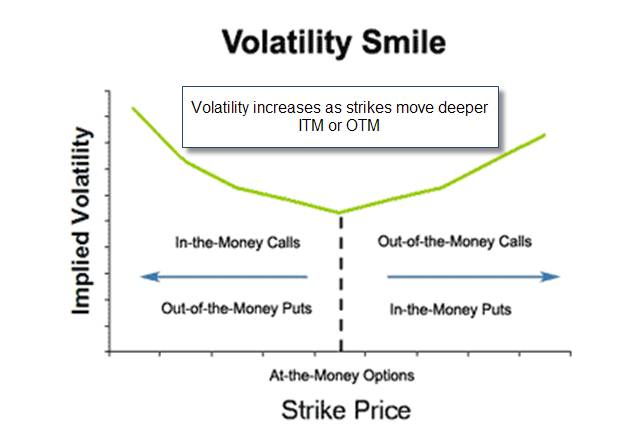

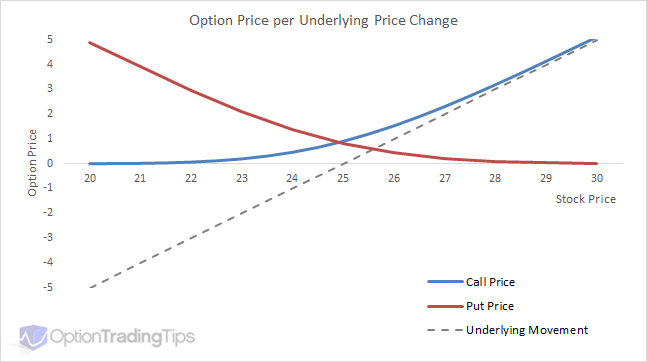

Volatility Skew- Understanding Option Premiums Over Different Time Frames and Strikes | The Blue Collar Investor

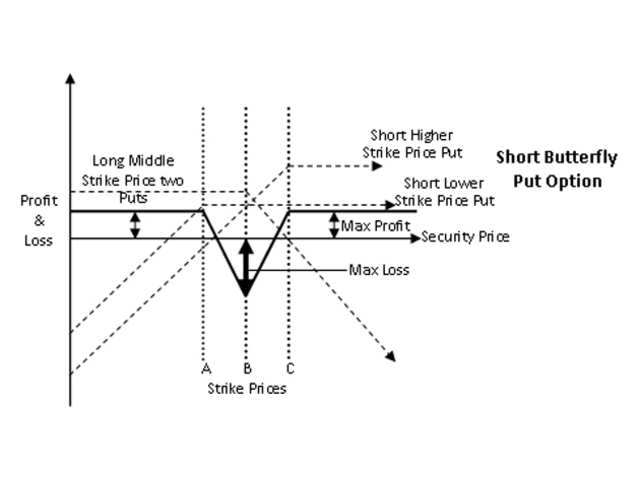

What is Butterfly Spread Option? Definition of Butterfly Spread Option, Butterfly Spread Option Meaning - The Economic Times

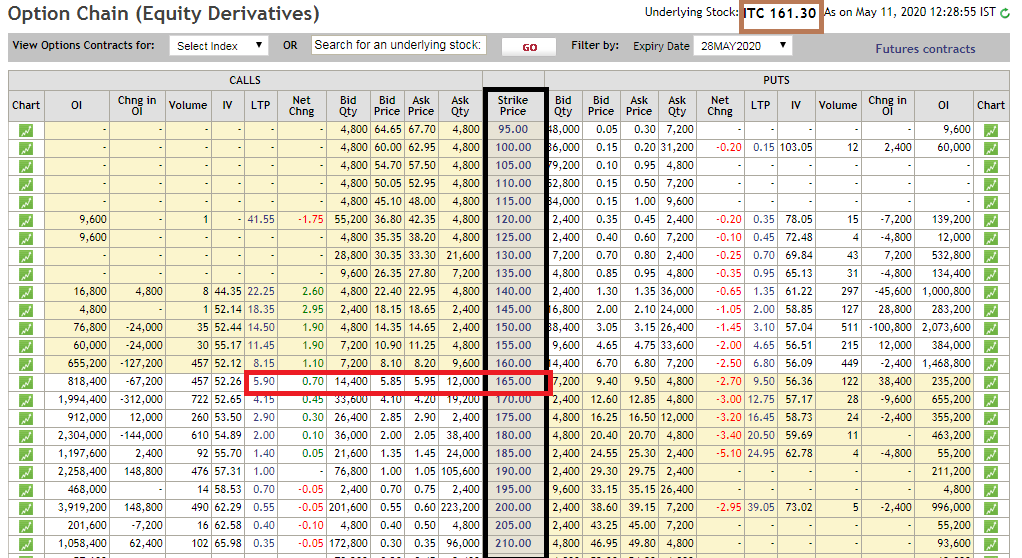

OI Restrictions, Strike Price Range only 450 points range? Really Bad - Zerodha - Trading Q&A by Zerodha - All your queries on trading and markets answered

:max_bytes(150000):strip_icc()/dotdash_Final_A_Newbies_Guide_to_Reading_an_Options_Chain_2020-01-92888ba78f8a4f519e037a483501af81.jpg)

/dotdash_Final_A_Newbies_Guide_to_Reading_an_Options_Chain_2020-01-92888ba78f8a4f519e037a483501af81.jpg)